My thoughts on portfolio diversification with international stocks and etfs

Past few days, I was thinking about

how to modify my existing portfolio for a possible downturn in US stock market.

In my retirement (401K and Roth IRA) and personal brokerage, about 90% holdings

are on US Stock and ETFs.

My portfolio is very much on

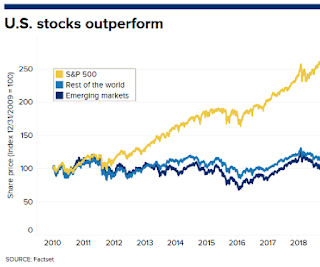

domestic equities and luckily, I ripped benefits from the roaring US equity

market in last several years. Same may not be true for our fellow investor friends

on other side of the pond or in Asia/Latin Americas. While our benchmark

S&P 500 index returned over 180% since 2010, rest of the world index

returned mere 15-20%.

I hope in 2020, US stock market

will keep roaring but analyzing the historical trends invoking some new

thoughts. Recently I came across a very concise article on this from Fidelity

Investment and here I am trying to summarize it.

Apparently, there is cyclical turn between

US vs International market for superior return and each cycle lasts on an

average 7.5 years. Currently we are slightly overrunning this average cycle, so

there might be better days ahead for international market.

This

following chart speaks a volume how this cycle is played out since 1972.

MSCI EAFE Index vs. S&P 500 Total Return Index. Source:

FactSet, as of Dec. 31, 2018. Past performance is no guarantee of future results.

It is not possible to invest directly in an index. All indexes are unmanaged.

Please see appendix for important index information.

In States, we are not much familiar

with large counterparts of US based companies. For an example, we are so

familiar with Johnson & Johnson or General Mills products in USA, however

not much familiar with the name "Unilever". In fact, Unilever is very large

consumer staples provider in Europe and Asia. Also, here in States, they

provide popular brands like Dove (Toiletries) and Lipton (beverages). Recently

I analyzed Unilever stock, seems like its growth and fundamentals are strong. Seriously

thinking of adding some in my portfolio!

International stocks can provide more

diversification benefits than US multinationals

|

|

3-year correlations with the S&P 500, 2016

to 2019

|

|

Consumer staples

|

|

General Mills (US)

|

0.55

|

Unilever (U.K.)

|

0.30

|

Auto

|

|

General Motors (US)

|

0.59

|

Honda (Japan)

|

0.54

|

Technology

|

|

Oracle (US)

|

0.72

|

SAP (Germany)

|

0.57

|

Source: Morningstar, as of September 30, 2019.

Company names shown here are for illustrative purposes only, are not

representative of all companies, and are not a recommendation or an offer or

solicitation to buy or sell any securities. Past performance is not a

guarantee of future results.

|

|

Its true that many large US based companies

have strong presence in overseas. Say Microsoft supplies Windows OS around the world,

same is true for Apple, Google, Ford, General Motors etc. However, it has shown

that their stock performance is highly correlated to US stock market, doesn't matter how much they are doing business elsewhere. So, if US

stocks market is down, their stock price takes a hit despite good business fundamentals .

So, a good combination of US and International stock/ETF may smooth out the turbulence

felt in either side of Atlantic and rest of the world.

Another important factor I was

thinking about the strength of US Dollar. Currently it is quite strong against

euro and other developed market currencies. However, this was not true throughout

last decades and probably won’t be same for coming decade. So hypothetically,

say once I start pulling money from my retirement account but if US Dollar

tanks, that may not be a sweet scenario for me.

So, considering all these, I am

actively reviewing some international stocks and ETF to invest in.

I will keep you guys posted on what

international stock and ETF will be

adding to my portfolio.

Disclaimer: This article shows my personal opinion and its for entertainment purpose only. This is no way professional financial advice. You may seek professional advice or conduct own research before investing.

Disclaimer: This article shows my personal opinion and its for entertainment purpose only. This is no way professional financial advice. You may seek professional advice or conduct own research before investing.