Will IT sector lead the future of stocks?

Hello folks!

Hope all are doing well! We

are having high infection rate in Texas, so I was mostly indoors during this 4th

of July break. In addition to all the turmoils, the movement in stock market is

giving me a hard time to concentrate. Seems like recent upward trend already

counted in post pandemic recovery although pandemic is nowhere near to be over.

Tesla stock is on fire and $1400 price point seems quite expensive to me.

Listening to few expert analysts, a good valuation may be around $800. I guess

lot of inflow to that stock is due to fear of missing out. As long as fed is pumping

zero interest money in market, I am not expecting much of pull back in this

market.

IT sector saw the most rapid

recovery from the march dip. Overall, I think work from home is going to be

here even pandemic is over. Also, most of large retailer are going to adopt

online based business model rather than brick and mortar stores. All these are

going to just drive the demand for software and IT infrastructure services.

Many software vendors like Microsoft not only saw rapid recovery from march

dip, they are now in all time high position.

Personally, I find it bit hard

to buy individual stocks of many large IT companies. For example, a single

stock of top three companies, Google ($1500), Apple Inc ($383) and Microsoft

($213). So, it’s hard for people with limited monthly investment budget to

participate in market. For this reason, I found investing with a well-rounded

ETF focused on IT sector works better for me. My favorite ETF is Vanguard

Information Technology (VGT) and last price I checked was $280.

The main positive side of this

ETF is its diversified portfolio. Currently it has holdings in 334 individual companies

involved in software, hardware, semiconductor and consulting services. About

60% of total asset is invested in these ten well known companies:

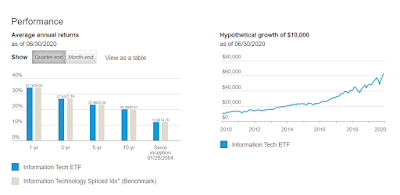

VGT was first introduced in

2004 (sweet 16!) and it achieved average annual return of almost 12%. I guess

it will be hard to find similar high return for so long in any other sector of economy.

If I would invest $10,000 back in 2010, I would end up now with about whopping $60,000!

Wish I was wise enough back then😊

One down side of this ETF is

it high Price to Earning ratio (P/E) of 28. I think this is bit overvalued, however

whole stock market especially S & P is also overvalued. Ideally, I like it

to be around 20 for this type of sector. But for me, it’s wiser to invest on

regular basis rather than waiting for a market pull back sometime in future. There is a saying "staying in market is more important than timing the market!". At

the end, dollar cost averaging will make pricing more reasonable over longer

time horizon. On up side, VGT has a return on equity of 26% and annual

earning growth rate of 18%. I am quite happy with these healthy fundamentals of

overall performances of holding companies.

In addition to VGT, I am also

investing in few other individual IT sector companies. Usually, I try to focus

on companies that are paying 3 to 4% of dividends with solid performance on

stock price growth. Hopefully, I will discuss this soon in another post.

Have a great day all!

Disclaimer: This article shows my personal

opinion and it’s for entertainment purpose only. This is no way professional

financial advice. You may seek professional advice or conduct own research

before investing. This site uses affiliated links and cookies. Please read the

disclaimer & Privacy section for details.

Comments

Post a Comment