Time is the best friend for a long term investor

I wish there were courses on investing while I was attending college or high school. Most of us has no clue how important is the contribution of time in growing a portfolio. I was lucky to land a well paid job right after college and spent all of salary on staying in luxury apartment, eating out every meal, traveling etc. Its true I enjoyed all that but I could achieve same gratification by cutting some corners on spending and invest the balance:)

Anyway, lets get some idea how important is to start investing as early as possible once someone starts earning.

Lets compare the investment strategy of two buddies Ian (The investor!) and Paul (The Procrastinator!)

Lets assume both get out of college at 25 and starts job at same salary of $3500/month after tax and both have a plan to retire at 60. Ian started investing at 25 while Paul waited until he reaches age of 35.

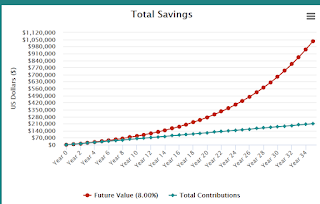

Now Ian starts adding $500/month to his brokerage or retirement account. Historically U.S stock market has returned about 10% on average and if we subtract 2% inflation, the effective return is about 8%.

At the age of 60 (35 years of investment), Ian's account is grown to almost $1.1 million and bulk of it (~0.9 million) came from compounded interest. So whopping 80% of his money came from compounding for which he really did not put any effort!

Now as Paul started at age of 35, so his investment period is 25 and at age of 60, his portfolio is only about $ 0.44 million and the contribution of compounding is about 60%.

So lets analyze a scenario where Ian started investing $500/month at age 25 and then stopped investing at age 50 and let his portfolio grow on its own. May be he has a health issue or took a part time job to get more free time to enjoy life!! At 50, his portfolio is about $0.44 million and additional 10 years of compounding made about $0.86 million.

Now its so mind boggling that both Ian and Paul invested same amount for same period of time but Ian ended up with twice amount of money to enjoy his retirement! All of it just cause Ian decided to start investing 10 years earlier!

I wish I knew this simple fact sooner than later 😂 However, I guess its never too late to start the journey!

Disclaimer: This article shows my personal opinion. This is no way professional financial advice. You may seek professional advice or conduct own research before investment.